VRARA members can access this report through a discounted subscription to ARtillery Pro.

ARtillery Intelligence has released a new report that projects headworn AR revenue to grow from $1.6 billion in 2020 to $17.7 billion in 2025, a 61.8 percent compound annual growth rate. Entitled Headworn AR Global Revenue Forecast, 2020-2025, the report examines glasses-based AR revenue totals and subsegments – including consumer and enterprise spending.

Enterprise spending holds a commanding revenue share today, eclipsing consumer spending by 100 to 1. This is driven by productivity gains in industrial settings, where AR’s line-of-sight guidance boosts speed and error reduction. Consumer AR meanwhile trails in revenue, as the technology isn’t yet stylistically viable for consumer markets. But spending shares will shift over time as consumer AR adoption gains ground in later years – partly accelerated by Apple’s projected market entrance.

“Apple's projected smart glasses could have a classic Apple 'halo effect' by boosting consumer awareness and demand for the emerging hardware category,” said ARtillery Intelligence Chief Analyst Mike Boland. “Moreover, its V1 design target will be style and wearability versus graphical immersiveness; and its appeal will lie in elegant integration with other Apple hardware and wearables. Think of it like the iPhone 1 – evolving over several years.”

In addition to Apple, Microsoft has already begun to accelerate the headworn AR market. Its $22 billion 10-year contract with the U.S. Army to supply battle-grade hololens units caused an inflection in 2021, and elevated revenues throughout this forecast period.

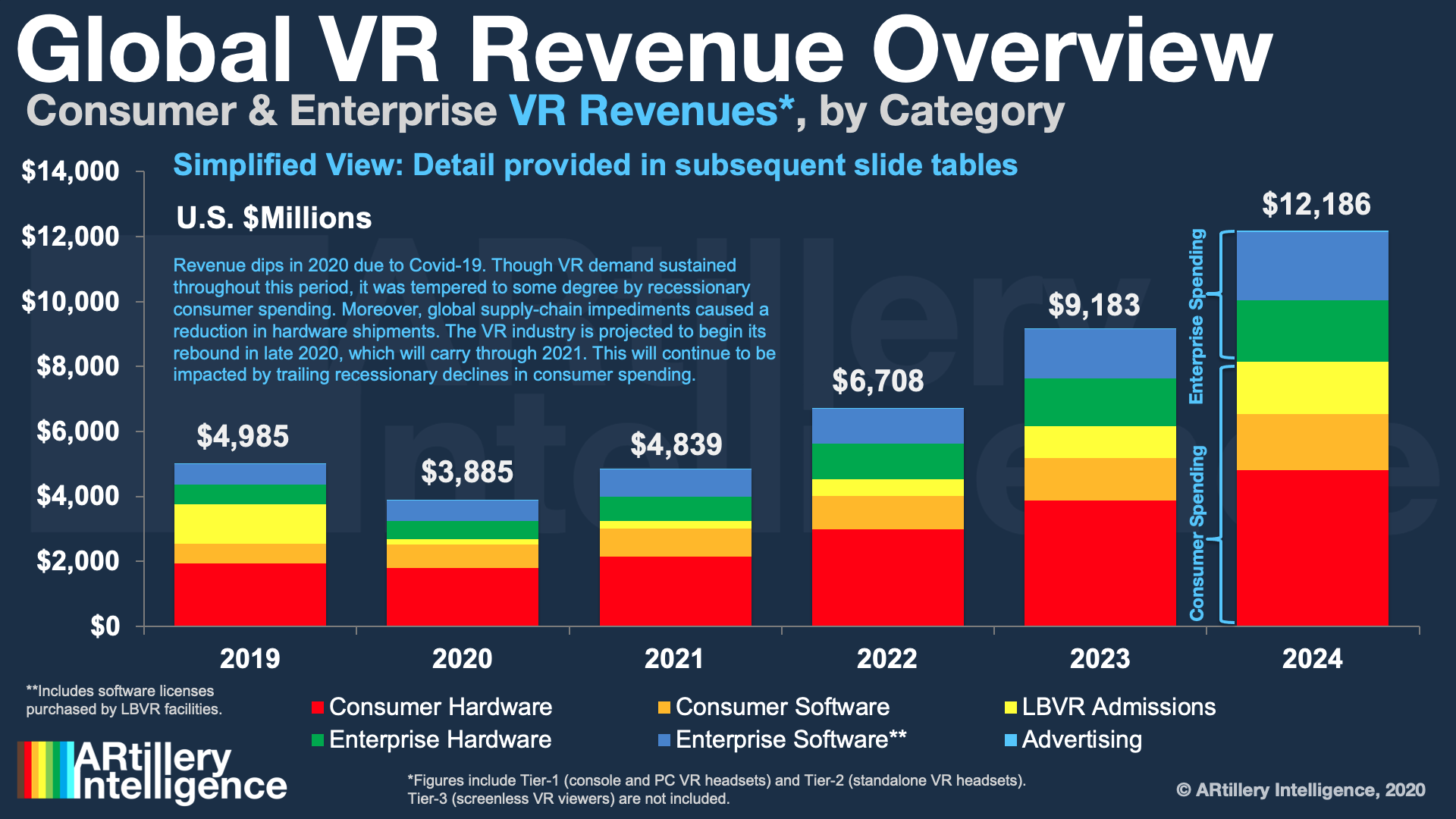

As is the case across the global economy, AR glasses revenues have been impacted in the COVID era. Given that the consumer AR glasses market is relatively small to begin with, its revenue has been minimally affected. Enterprise markets have conversely suffered to some degree due to recessionary spending and supply-chain impediments. However, enterprise AR use cases support COVID-era demand signals, thus offsetting declines.

“Certain flavors of enterprise AR like virtual assistance and guided maintenance align with remote work in some corporate and industrial settings,” said Boland. “This could mean that COVID-pressured adoption in some fields engenders new enterprise habits that sustain into a post-COVID era of hybrid remote work.”

Report Availability

Headworn AR Global Revenue Forecast, 2020-2025 is available to ARtillery PRO subscribers, and more can be previewed here. VRARA members can access this report through a discounted subscription to ARtillery Pro.

About ARtillery Intelligence

ARtillery Intelligence chronicles the evolution of spatial computing, otherwise known as AR and VR. Through writings and multimedia, it provides deep and analytical views into the industry’s biggest players, opportunities and strategies. Products include the AR Insider publication and the ARtillery PRO research subscription. Research includes monthly narrative reports, market-sizing forecasts, consumer survey data and multimedia, all housed in a robust intelligence vault. Learn more here.