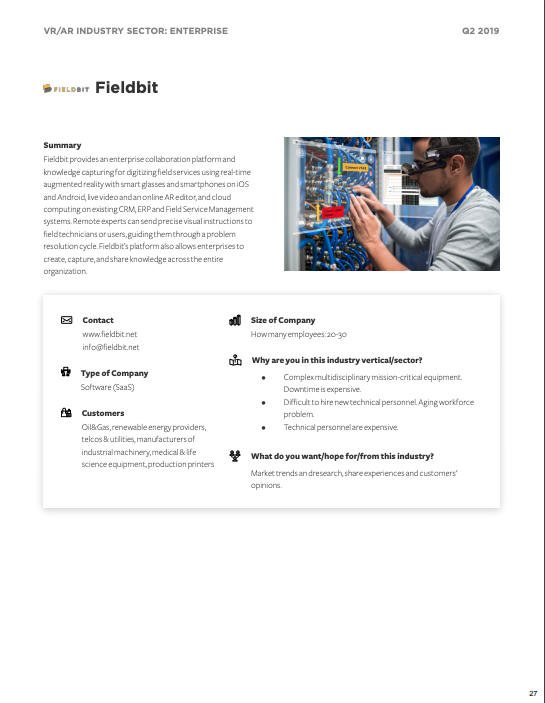

For manufacturing, service, and other industrial markets, the skills shortage problem is well documented, and it shows no signs of slowing. Frequently attributed to aging experts exiting the workforce via retirement, the role this trend is playing shouldn’t be overlooked—in the next few years, over a quarter of all manufacturing workers will be older than 55. However, the skills resource problem is more nuanced than age-based attrition.

Augmented reality has been heralded as the solution, but AR isn’t one-size fits all; it’s highly customizable and requires proper direction to solve specific problems. To successfully address the skills deficit with AR, it is important to recognize the four factors that are contributing to your skill drainage.

Lack of systems to produce new skilled workers

Simply put, there’s a lack of systems to put people on the path towards becoming skilled experts. Students are increasingly encouraged to pursue traditional college degrees rather than careers in skilled work, due to societal and economic factors. Technical schools have also broadened their focus to include IT curriculum, and many secondary education districts have reduced courses that expose students to labor skills. But while STEM initiatives are up, the focus is often on utilizing those skills outside of a manufacturing context.

While the industry needs to address these underlying trends to increase demand for manufacturing jobs, AR can provide an important stopgap. AR-delivered training has proven to both accelerate skills development and improve competency outcomes, which allows manufacturers to get more expertise from smaller pools of candidates.

Competition with other types of jobs

As manufacturing has seen declining preparation and focus in education systems, it also must contend with competition with other job options once students graduate. Potential employees are being lured away to retail, construction, shipping and transportation and service sector industry jobs—even if long-term career benefits for these jobs are not as good. These jobs are frequently more ubiquitous in populous areas, and have a lower barrier to entry.

Innovative technologies like AR can help the manufacturing industry appeal to a new generation of students consisting of “digital natives”. AR-driven training and guidance can help to quickly upskill novice technicians while bringing the allure of working with exciting emerging technology solutions.

Continued global expansion

Global expansion is a complex issue that affects the skill gap in multiple ways. Primarily, it reflects an exodus of manufacturing jobs from industrialized nations to countries where the cost of living and salaries are lower. While this reduces costs of operations for large enterprises and helps create global economic growth, it has also contributed to the skills gap. Manufacturing increasingly becomes considered an outsourced occupation—which can hinder companies that desire or require operations in more developed economies. It also creates a burden for companies that must increasingly manage localized processes, from training and guidance, to translation, to local compliance and governance.

AR is a communication medium that can massively reduce localization requirements, both in providing new training and in ongoing guidance. Content is easily adapted to local languages, but more importantly, AR also relies heavily on iconography, design files, products themselves, and other elements that reduce the amount of text-based content.

Increasing product complexity

While the previous factors deal primarily with workforces, product complexity represents a different type of skills gap pressure. Competition and evolving market conditions have accelerated the need to customize and personalize products, requiring more intricate and agile operations and a wider variety of processes for individual skilled workers. Product complexity also requires manufacturers to better facilitate the documentation, management, and delivery of training and guidance. This pressure increases with accelerated, on-demand processes.

Industrial enterprises can now use AR to easily update and deliver manuals and guides almost immediately, instead of reprinting and shipping them to reflect product variance. Even relative to PDF and digitized manuals, AR is easier to navigate and select. Hands-free, over-the-shoulder guidance allows workers to easily understand instructions for different assembly, operation, or maintenance variations.

Addressing complex challenges requires a multi-faceted skills solution: augmented reality

The skills shortage is a complex problem that requires manufacturers to change how they recruit talent, manage their resources, and even how they interact with government agencies as they lobby for workforce-friendly legislation. And while there is no single answer, augmented reality is proving to be a game-changer for how industrial companies onboard, upskill, and empower their employees. In fact, industrial applications of augmented reality are predicted to far outpace all other types of AR investment over the next half-decade.

To learn more about why augmented reality is so effective for training and guidance, the innovative ways its being implemented, and how you can harness AR for rapid value, download this complementary eBook: Closing the Industrial Skills Gap with Augmented Reality.